Treasury Holdings

Backing $MYO's underlying value with real cash flows

Myosin DAO’s Treasury will use its revenue, as stated in Revenue Streams, in the following manner.

To ensure stability and a strong financial foundation for Myosin DAO, each $MYO is backed by two key cryptocurrency assets: ETH (Ethereum) and USDC (a stablecoin pegged to USD at a 1:1 ratio). We decided to hold ETH and USDC because we believe ETH is a blue chip crypto asset with strong growth potential, and USDC as a leading stablecoin with minimal risks of insolvency.

All Treasury revenues from projects will be systematically swapped EOD for ETH & USDC

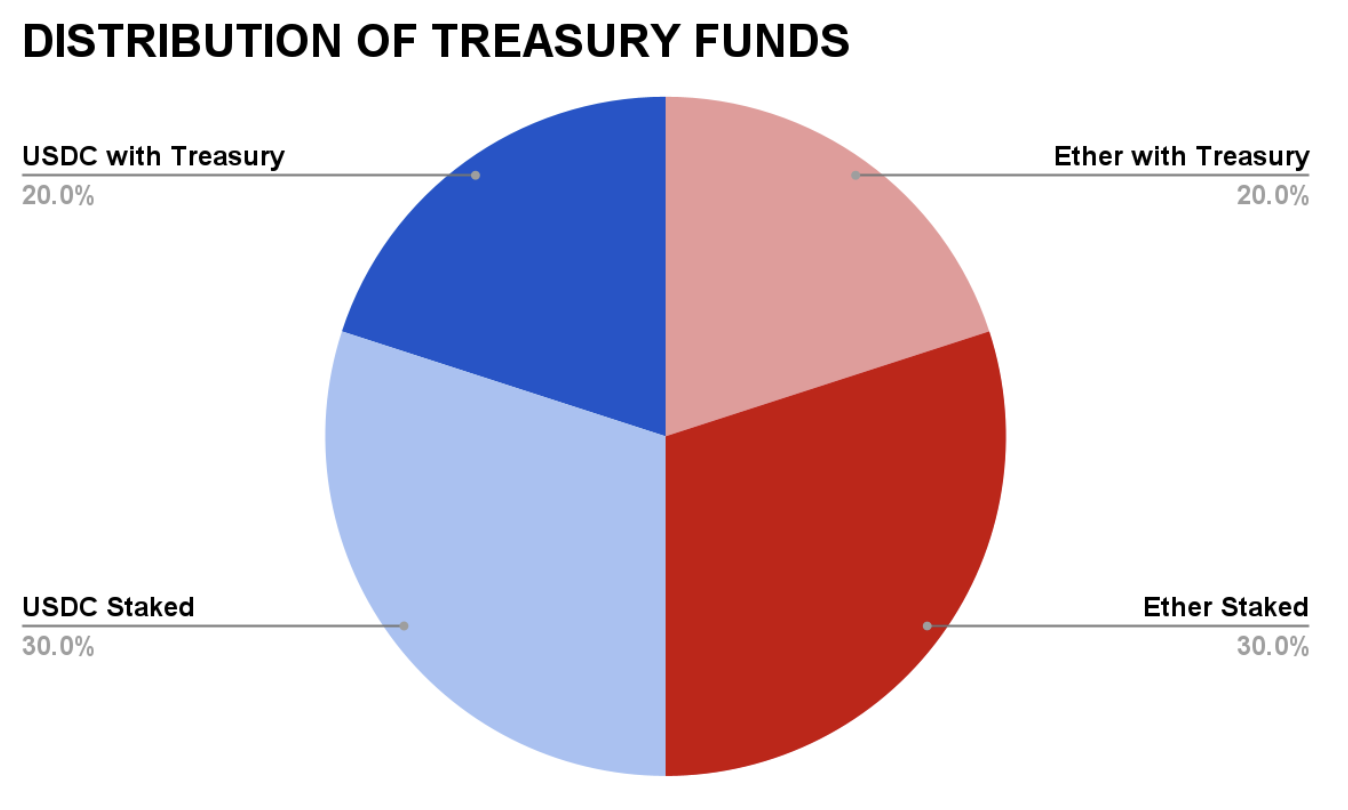

Myosin DAO Treasury will aim to 20% of its funds in liquid ETH and 20% in liquid USDC. In times like the current bear market, we will focus on accumulating mostly $USDC, and selectively DCA'ing into ETH.

Myosin DAO Treasury will aim to stake the remaining 60% of funds to generate stable financial returns, further increasing the value of the Treasury and the value of $MYO itself. In times like the current bear market, we will aim to stay liquid.

Example: Suppose after one successful campaign, earned service revenue is worth $100,000.

In this case:

The team and its members will receive a total of US $70,000 (70%)

The originator of the project/deal will receive $10,000 (10%)

Myosin DAO Treasury will receive $20,000 (20%)

$10,000 USD is swapped for $10,000 worth of ETH

$4,000 goes directly to the Treasury as liquid ETH

$6,00 is used to lend or farm yield through a platform such as Aave or Lido Finance

$10,00 USD is swapped for $7,500 worth of USDC

$4,000 goes directly to the Treasury as liquid USDC

$6,000 is used to lend or farm yield through a platform such as Aave

Last updated